What kind of Credit do you need to buy a home?

What kind of Credit Score do you need to buy a house?

I often get asked how to people get ready to buy a house, and it’s easy. First, there’s a little bit of homework you need to do, and that’s getting ready to find the best loan option to buy a place.

Now, you can read this article, or, you can give me a call and I can walk through all of this with you! For those who like to research, this article is for you!

Building Good Credit

Having good credit is one of the big items needed to get pre-approved. This helps lenders identify what loans and interest rates you can qualify for. Your credit score tells lenders how risky you are to lend money to.

Taking steps to improve your credit score and reduce your debt can pay off big as you prepare to get a mortgage. Better numbers mean better loan options with lower interest rates. But don’t feel like you have to pay off all your debts, sometimes it’s better to have money saved then be debt free. A loan officer can help you build your strategy. I have some great loan officers I can recommend to get you in the right direction!

Your credit score is based on the following information:

- Payment history

- Amount of money you owe

- The length of your credit history

- Types of credit you’ve used

- Your pursuit of new credit

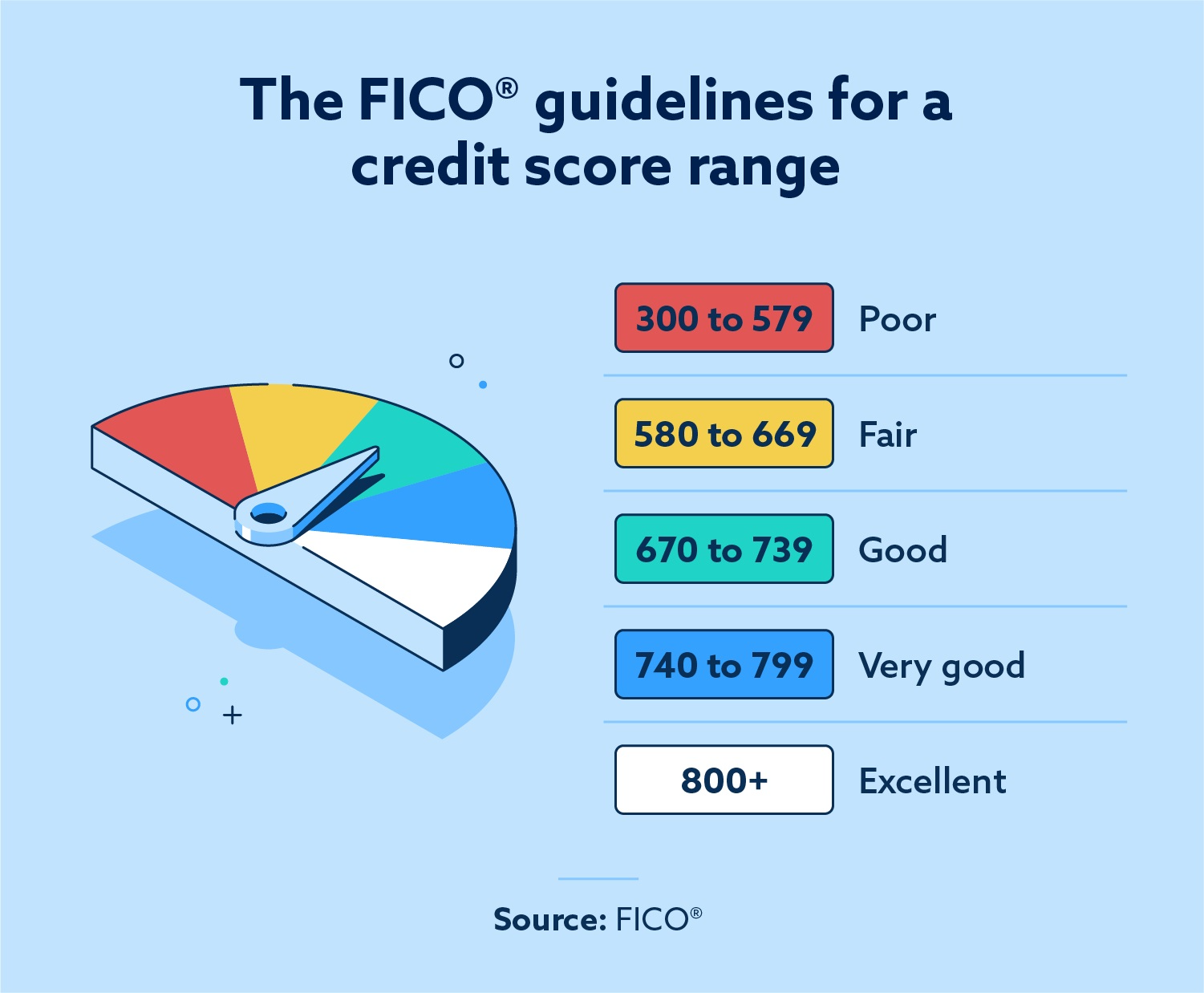

So what FICO score do you need to qualify for a home loan?

Most lenders require a credit score of at least 580. However, a score of 620 will allow you to qualify for more options. A score above 700 will generally get you great loan terms.

Here’s a list of the loan types available:

- Conventional Loans

- FHA Loans

- USDA Loans

- VA Loans

Want to know more? Don’t know a loan officer? I can connect you to a variety of loan officers I know who are experienced and who can steer you in the right direction.

Recent Posts

GET MORE INFORMATION